INOVASI FINTECH DAN IMPLIKASINYA TERHADAP PERBANKAN KONVENSIONAL DI ERA MASYARAKAT DIGITAL

DOI:

https://doi.org/10.23969/jp.v9i3.20166Keywords:

Fintech, Conventional, Community, Digital InnovationAbstract

The aim of this research is to analyze the impact of Financial Technology (FinTech) innovation on conventional banking and identify the challenges and opportunities that arise in the era of digital society. This research also aims to explore how conventional banks can adapt to technological developments and competition from FinTech companies. The research method used is a qualitative method with a case study approach. Data was collected through in-depth interviews with professionals in the financial industry, document analysis, and a review of relevant literature. Data analysis was carried out thematically to identify patterns and relationships between the variables studied. The research results show that FinTech innovation brings various benefits to consumers, such as ease of access, speed of service, and lower costs. However, conventional banks face significant challenges in adapting to new technology and the more flexible business models of FinTech companies. Conventional banks that successfully adapt are those that are able to integrate digital technology into their operations, collaborate with FinTech companies, and offer more personalized and innovative services. This research also finds that regulations that are adaptive and support innovation are very important to create a balanced financial ecosystem. Conventional banks need to develop comprehensive digital strategies to remain relevant and competitive in this digital era. With the right strategy, conventional banks can increase operational efficiency, expand service coverage and improve customer experience. This research provides valuable insights for conventional banks, FinTech companies and regulators in managing the dynamics of the financial industry in the digital era, as well as encouraging the creation of an innovative and inclusive financial ecosystem.

Downloads

References

Tsakila, Nur Fazri, et al. "Analisis Dampak Fintech terhadap Kinerja dan Inovasi Perbankan di Era Ekonomi Digital." Indonesian Journal of Law and Justice 1.4 (2024): 11-11.

Subagiyo, Rokhmat. "Era Fintech: Peluang Dan Tantangan Bagi Ekonomi Syariah." El-Jizya: Jurnal Ekonomi Islam 7.2 (2019): 316-336.

Nurfalah, Irfan, and Aam Slamet Rusydiana. "Digitalisasi keuangan syariah menuju keuangan inklusif: Kerangka maqashid syariah." Ekspansi: Jurnal Ekonomi, Keuangan, Perbankan, Dan Akuntansi 11.1 (2019): 55-76.

Swetasoma, Cokorda Gede. "Proyeksi Pengaturan Neo Bank Dalam Masa Depan Perbankan Di Indonesia." Jurnal Yustitia 16.1 (2022): 88-103.

Setiani, Dina Dwi, et al. "Fintech syariah: manfaat dan problematika penerapan pada UMKM." Jurnal Masharif Al-Syariah: Jurnal Ekonomi Dan Perbankan Syariah 5.1 (2020).

Setiani, Dina Dwi, et al. "Fintech syariah: manfaat dan problematika penerapan pada UMKM." Jurnal Masharif Al-Syariah: Jurnal Ekonomi Dan Perbankan Syariah 5.1 (2020).

Fajria, Rola Nurul. "Potensi Sinergitas Fintech Dengan Bank Syariah Dalam Meningkatkan Kinerja Perbankan Syariah Di Indonesia." MALIA: Journal of Islamic Banking and Finance 3.2 (2019): 174-181.

Manggala, Bayu Suryadi, et al. "Analisis Regulasi Fintech dan Implikasinya Terhadap Operasional Bank Digital Dalam Studi Kasus Indonesia." Media Hukum Indonesia (MHI) 2.3 (2024).

Harahap, Berry A., et al. "Perkembangan financial technology terkait central bank digital currency (cbdc) terhadap transmisi kebijakan moneter dan makroekonomi." Bank Indonesia 2.1 (2017): 80.

Qur’anisa, Zulfa, et al. "Peran Fintech Dalam Meningkatkan Akses Keuangan Di Era Digital: Studi Literatur." GEMILANG: Jurnal Manajemen dan Akuntansi 4.3 (2024): 99-114.

Nugroho, Vania Armilda Sari, and Luki Kurniawan. "Pengaruh Teknologi Fintech dalam Transformasi Industri Asuransi dan Implikasi Regulasi di Indonesia." Hakim: Jurnal Ilmu Hukum dan Sosial 2.1 (2024): 235-245.

Aprianti, Ine, and Lucy Nurfadilah. "Tantangan yang dihadapi oleh Perbankan Nasional pada Aplikasi Financial Technology Berbasis Cashless (Studi Kasus pada Pengguna Digital Payment di Kota Bandung)." Jurnal: Bisnis Dan Iptek 12.2 (2019): 68-78.

Aprianti, Ine, and Lucy Nurfadilah. "Tantangan yang dihadapi oleh Perbankan Nasional pada Aplikasi Financial Technology Berbasis Cashless (Studi Kasus pada Pengguna Digital Payment di Kota Bandung)." Jurnal: Bisnis Dan Iptek 12.2 (2019): 68-78.

Lukita, Chandra, and Adam Faturahman. "Perkembangan fintech terhadap crowdfunding dan blockchain di era disrupsi 4.0." Jurnal MENTARI: Manajemen, Pendidikan dan Teknologi Informasi 1.1 (2022): 9-19.

Sukardi, Budi. "Blockdentity: Masa Depan Di Luar Identitas DigitaL." Fintech dalam Keuangan Islam: Teori dan Praktik (2022).

Husna, Fathayatul. "Wajah Ekonomi 4.0: Perbankan Syari'ah Digital, Peningkatan Daya Saing dan Strategi Dakwah Islam." Idarotuna 3.1 (2020): 59-70.

Downloads

Published

Issue

Section

License

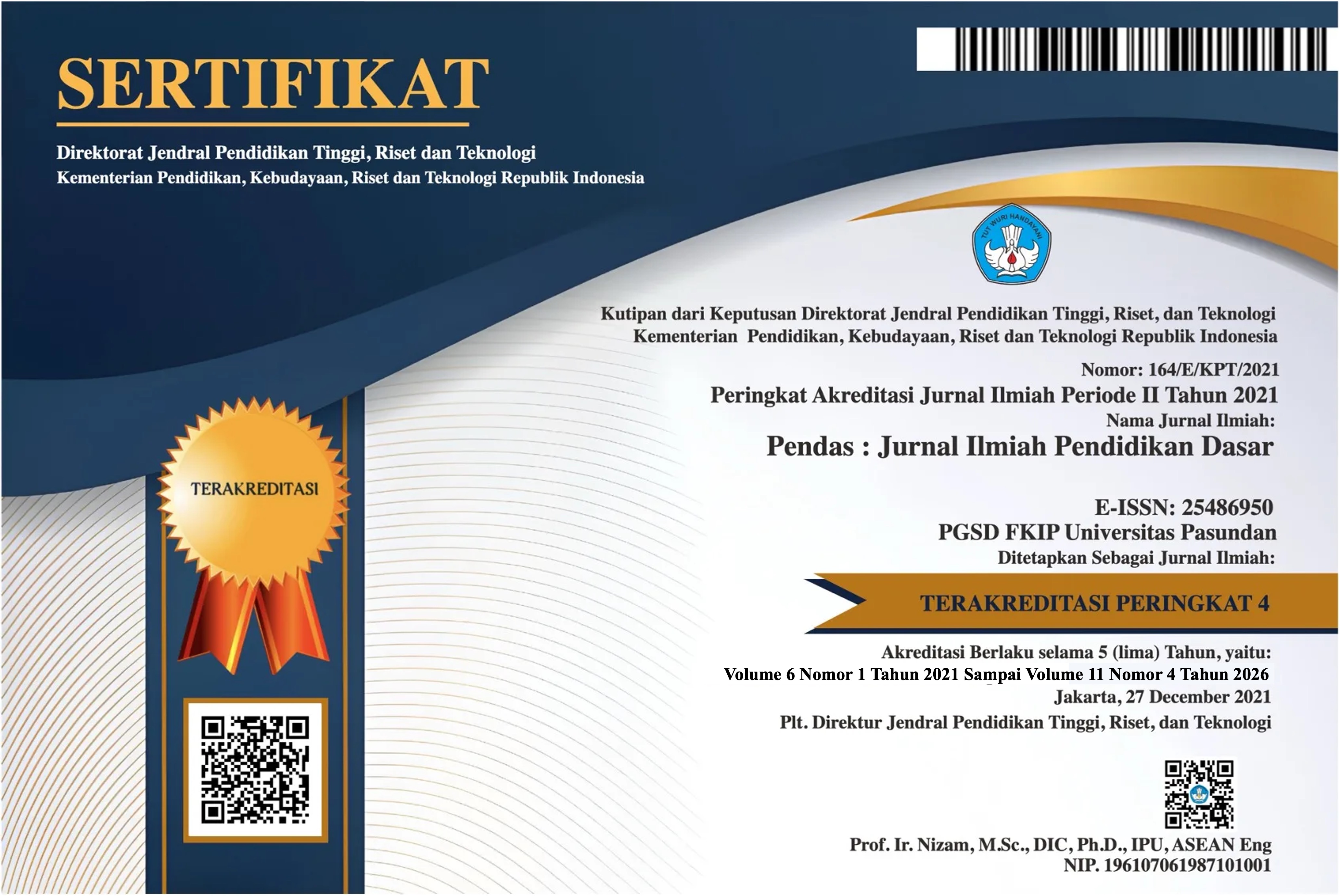

Copyright (c) 2024 Pendas : Jurnal Ilmiah Pendidikan Dasar

This work is licensed under a Creative Commons Attribution 4.0 International License.