Analisis Mengeringnya Likuiditas Perbankan sebagai Ancaman terhadap Denyut Perekonimian Indonesia

DOI:

https://doi.org/10.23969/jp.v10i04.36619Keywords:

Liquidity, Liquidity Risk, Banking Profitability, NPL, LDR, Economic StabilityAbstract

This study analyzes the tightening of banking liquidity in Indonesia and its potential threat to national economic stability. Using a literature review approach, this research synthesizes theoretical frameworks and empirical findings related to liquidity risk, credit risk, and macroeconomic pressures affecting the banking sector. The results indicate that liquidity shortages are driven by slowing growth in third-party funds, increasing Loan to Deposit Ratio (LDR), rising Non-Performing Loans (NPL), and global financial volatility such as interest rate hikes and exchange rate fluctuations. These conditions collectively weaken banks’ capacity to meet short-term obligations and maintain intermediation functions. Liquidity risk also negatively affects banking profitability by increasing funding costs, reducing net interest margins, and limiting credit expansion. At the macro level, persistent liquidity pressures may escalate into systemic risks, trigger bank runs, reduce credit distribution to the real sector, and ultimately hamper economic performance. This study emphasizes the importance of strengthened macroprudential policies, improved liquidity management, and coordinated financial regulations to safeguard financial system stability in Indonesia.

Downloads

References

(1) Ali, M. (2004). Manajemen Risiko Likuiditas Perbankan. Jurnal Keuangan dan Perbankan, 8(2), 101–113.

(2) Adesina, K., & Adewumi, A. (2022). Bank Liquidity, Profitability, and Economic Stability in Developing Countries. International Journal of Economics and Finance, 14(3), 55–68.

(3) Akerlof, G. (1970). The Market for Lemons: Quality Uncertainty and the Market Mechanism. Quarterly Journal of Economics, 84(3), 488–500.

(4) Anam, A. K. (2013). Kinerja Perbankan di Indonesia dan Pengaruh Risiko Kredit terhadap Likuiditas. Jurnal Ekonomi dan Bisnis, 10(1), 1–16.

(5) Chaplin, S., Emblow, A., & Michael, I. (2000). Banking System Liquidity: Developments and Issues. Bank of England Quarterly Bulletin, 40(2), 99–111.

(6) Crowe, K. (2009). Liquidity Risk Management—More Important Than Ever. Journal of Risk Management in Financial Institutions, 3(1), 12–18.

(7) Diamond, D. W., & Rajan, R. G. (2005). Liquidity Shortages and Banking Crises. Journal of Finance, 60(2), 615–647.

(8) Fadila, F., Findiana, F., & Jasri, Y. (2024). Pengaruh Risiko Likuiditas terhadap Stabilitas Bank di Indonesia. Jurnal Keuangan Kontemporer, 6(2), 43–58.

(9) Gazi, M., Rahman, M., & Karim, S. (2024). Credit Risk, Profitability, and Liquidity Interactions in Asian Banking. Asian Economic and Financial Review, 14(1), 11–25.

(10) Gurley, J., & Shaw, E. (1960). Money in a Theory of Finance. Stanford University Press.

(11) Hariyadi, M. (2021). Analisis Likuiditas terhadap Kinerja Keuangan Perbankan. Jurnal Akuntansi & Keuangan, 13(1), 25–38.

(12) Herawati, H., & Kusumargiani, I. (2022). Analisis Kinerja Risiko Likuiditas Sebelum dan Selama Pandemi pada Bank Mandiri. Jurnal Manajemen dan Keuangan, 2(2), 37–47.

(13) Maheswari, I. (2021). Pengaruh Risiko Kredit terhadap Profitabilitas Perbankan. Jurnal Ilmu Ekonomi & Bisnis, 8(4), 101–112.

(14) Mishkin, F. (2016). The Economics of Money, Banking, and Financial Markets (11th ed.). Pearson.

(15) Muchtar, E. (2017). Dampak BI Rate terhadap Likuiditas PT BPD Jawa Barat dan Banten Tbk. Jurnal Riset Keuangan, 5(1), 55–68.

(16) Olofin, S., Shittu, R., & Adedeji, W. (2024). Liquidity Risk and Bank Profitability in Emerging Markets. International Journal of Banking Research, 7(1), 20–34.

(17) Salsabila, H., Adel, S., & Aldina, F. (2024). Analisis Risiko Keuangan pada Perusahaan di Era Ketidakpastian Ekonomi Global. Jurnal Ekonomi Global, 1(4), 570–582.

(18) Shaw, G. (2015). Financial Intermediation and Liquidity Creation in the Modern Banking System. Journal of Financial Studies, 12(1), 44–59.

(19) Todaro, M., & Smith, S. (2015). Economic Development (12th ed.). Pearson Education.

(20) Zafira, D. J. (2023). Analisis Early Warning Indicator Risiko Likuiditas Perbankan Indonesia. Jurnal Keuangan & Perbankan, 6(2020), 415–429.Fadila, F., Findiana, F., & Jasri, Y. (2024). Pengaruh Risiko Likuiditas Terhadap Stabilitas Bank Di Indonesia. 6(2), 43–58.

Downloads

Published

Issue

Section

License

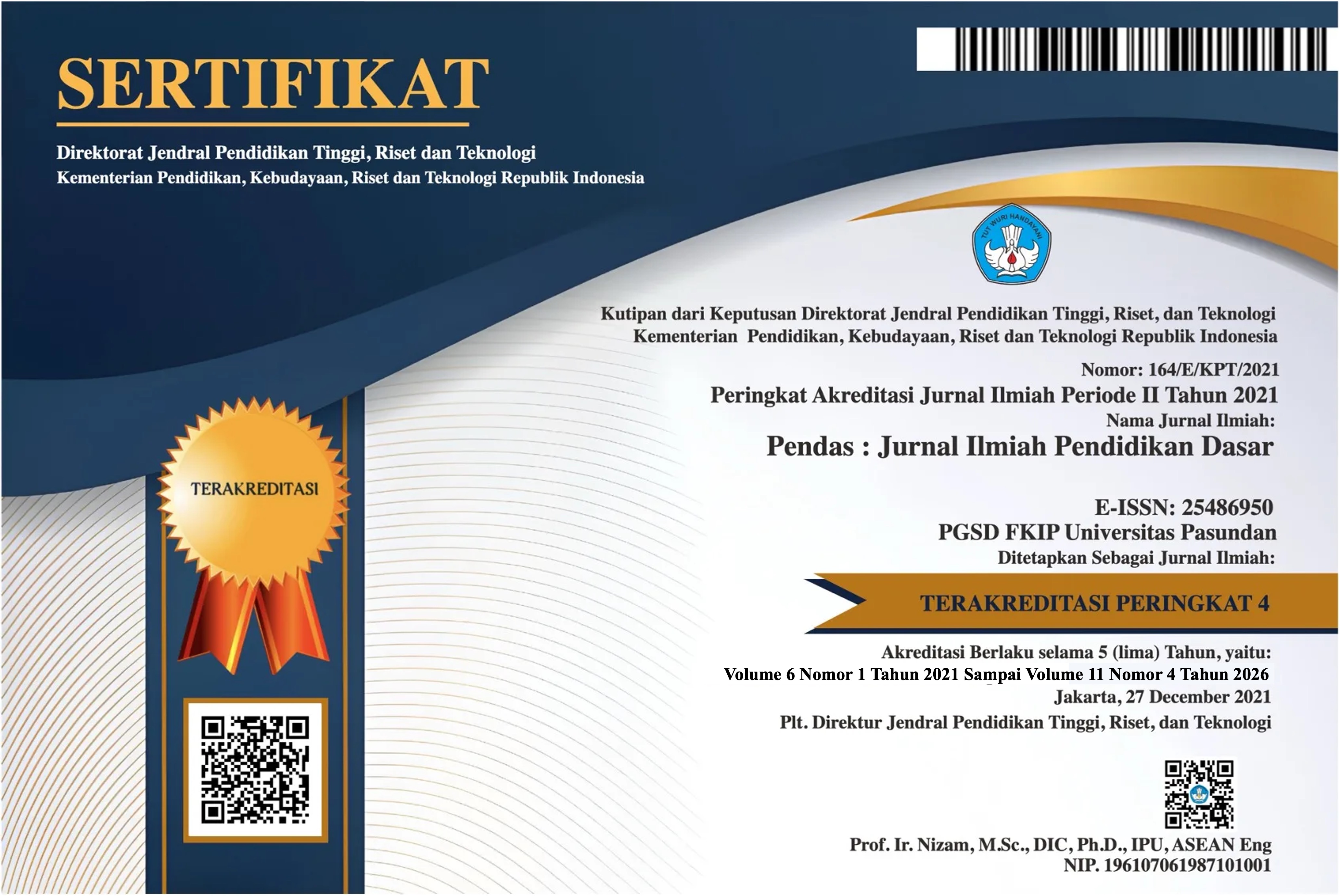

Copyright (c) 2025 Pendas : Jurnal Ilmiah Pendidikan Dasar

This work is licensed under a Creative Commons Attribution 4.0 International License.